Every now and then, we get a few questions about stock market terminology. The most common question that we’ve heard lately is “what is premarket stock trading?” Well, we’re happy to oblige! Here’s a summary of premarket trading, and its potential benefits to you.

What is Premarket Stock Trading?

Premarket stock trading is pretty much precisely what the name implies. It is all trading that occurs before the markets open. The New York Stock Exchange, for example, is open from 9:30 in the morning until 4:00 in the afternoon. So, premarket trading on the NYSE is anything that happens before 9 in the morning.

Generally speaking, most premarket trading happens between around 7 or 8 and 9:30 in the morning. And it’s important to note that not all brokerages will allow it. So because the markets aren’t yet open and not everyone will participate, there’s usually not a whole lot that goes on during premarket hours.

Should you Participate in Premarket Trading?

Premarket trading can be extremely beneficial to investors. There are a number of reasons for this. The first reason is that companies often release quarterly earnings reports in the wee hours of the morning, so an investor may be able to take advantage of any indicators that the reports may provide.

Secondly, the same applies for news. If an acquisition, a natural disaster or another event which could impact the markets occurs while the markets are closed, premarket trading will allow investors to jump on a transaction, rather than wait until the markets open.

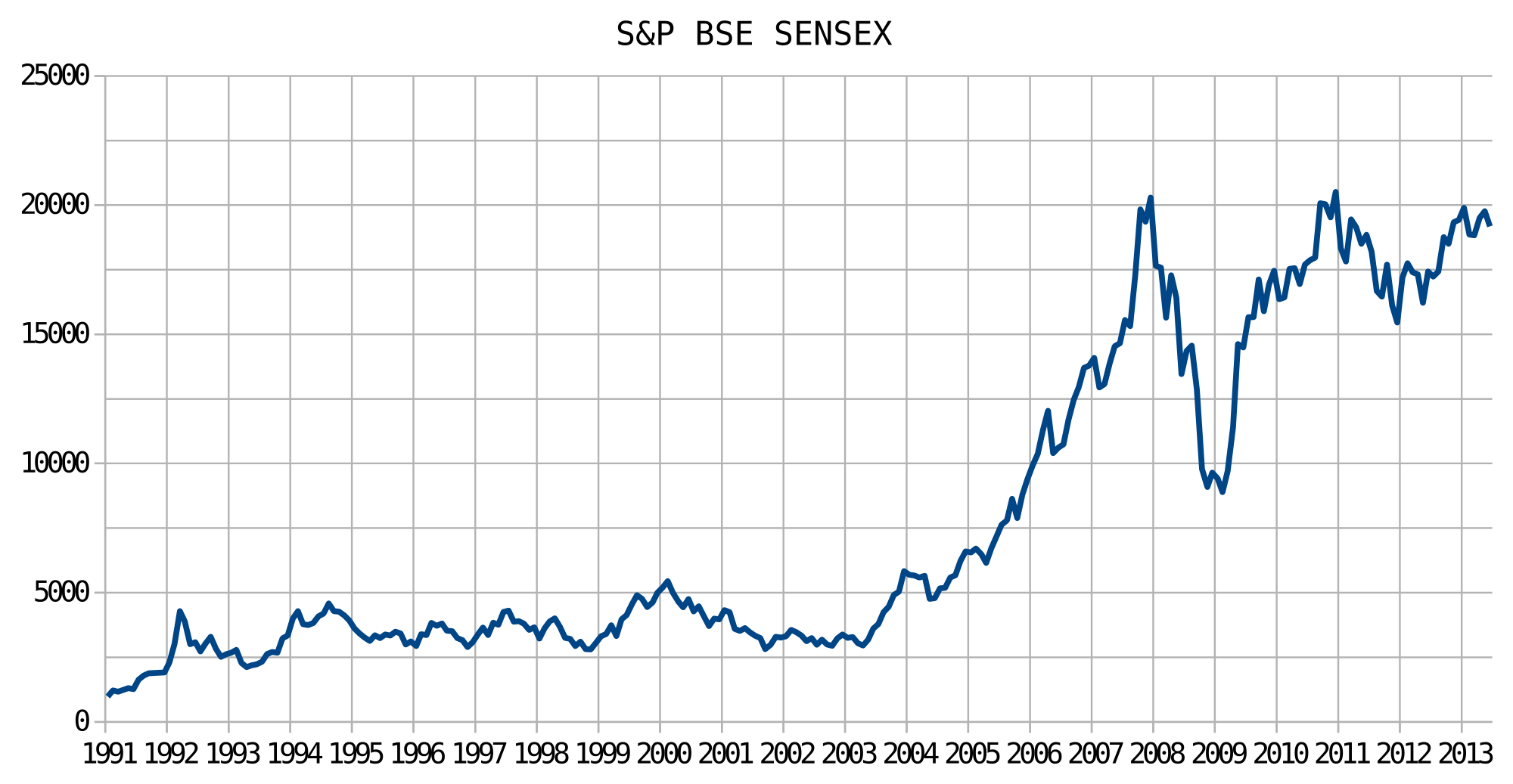

Finally, there are a lot of people who make a living analyzing the stock markets. They’re studying market trends, economic indicators and other factors which could influence your transaction decisions. Reports of those economic indicators are released at 8:30 in the morning, an hour before the markets open. Premarket trading will allow you to use this news, and give you a head start on trading for the day.

How to Participate in Premarket Trading

As we mentioned, not all stock brokers will allow you to participate in premarket trading. Some brokers will restrict transactions to regular trading hours only, so make sure you do a bit of research with your broker before you decide you want to trade during premarket hours.

If you’re using an online platform or an app on your device, you should read the fine print before you sign up. But if your broker or app does allow it, it’s quite simple. Just designate the transaction that you’d like to perform, pay any applicable fees, and you’re set.

Premarket Trading Hours (US, UK)

Obviously, the premarket stock trading hours will differ from stock market to stock market and from timezone to timezone. There is no set time, as the premarket hours in one country could be the trading hours in another.

To see the exact hours for yourself on markets like the London Stock Exchange, as well as China Stock Market, just pay a visit to our Stock Market Trading Hours page. This will tell you when the stated hours are for each market; when the holidays and non-trading days are; and more. From this you can work out when the pre-market trading hours will be.

You can also pay a visit to the main stock market pages. All major stock exchanges have these, from the US markets to markets in Pakistan and Australia. As an example, the NYSE main page can be found on NYSE.com.

The Downside to Premarket Trading

It may sound pretty cool to be able to trade before the stock market wakes up. But as we mentioned, the markets are pretty thin, and it may actually work in your favor to wait. If you decide to do it anyway, be sure that your transactions are based on research and not following the lead of other investors.

The biggest reason you might have to wait is that when those earnings reports are released, thousands of other investors will decide that they either do or don’t like the results. They’ll be quick to make snap decisions, and buy or sell their stock without having fully comprehended the scope of the report.

So in summary, premarket trading is trading that occurs before the markets are open. Is it beneficial to you? Maybe. But you’ll need to make sure you put your research into it first, and avoid jumping to conclusions before you make that trade.